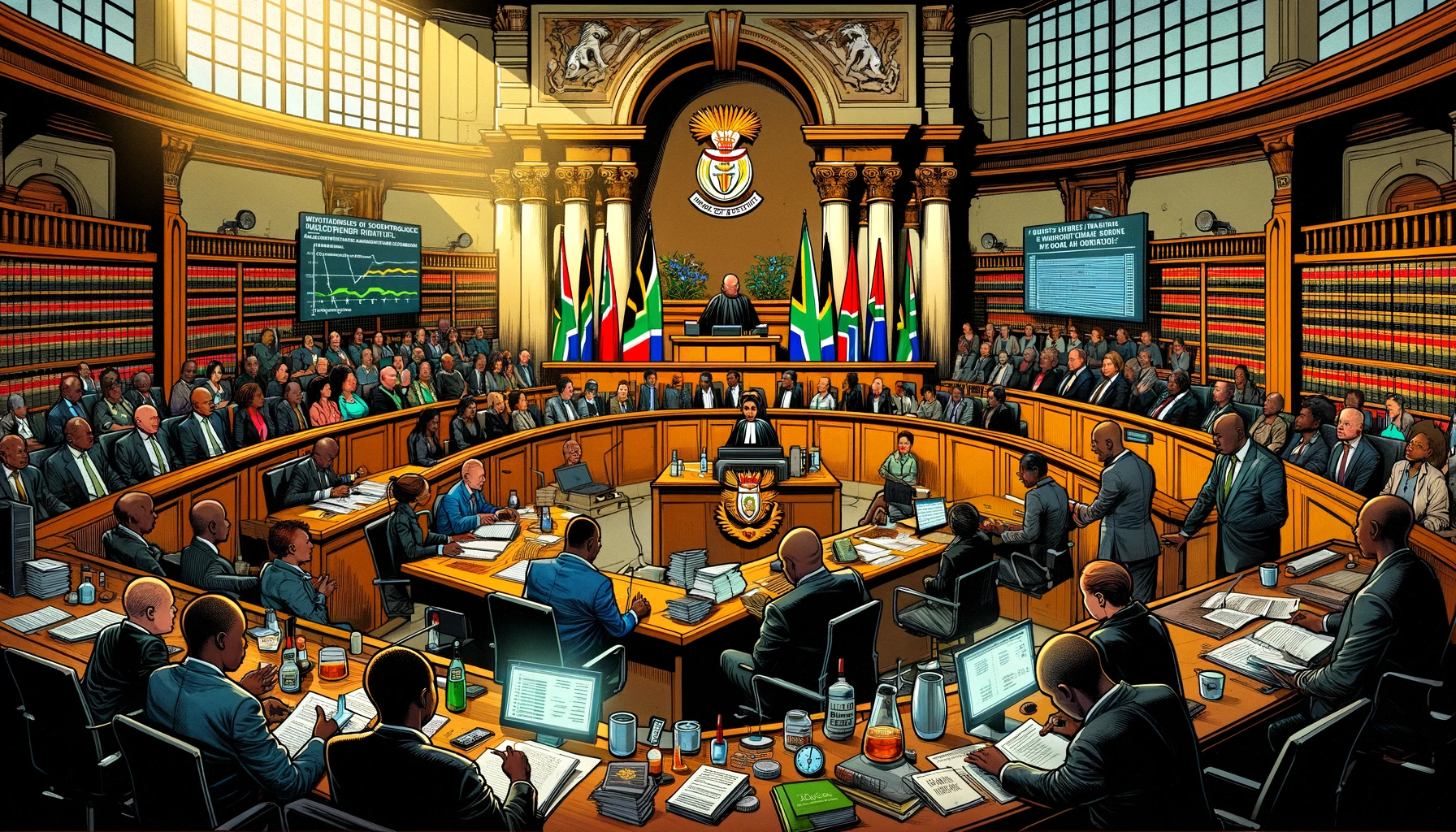

Dreyer V Afristat Investment Holdings (030942/22) [2024] ZAGPPHC142

In the fascinating realm of corporate law, a recent judgment from the North Gauteng High Court has shed light on the intricate dynamics of winding up a solvent company. The case in point, Dreyer v Afristat Investment Holdings, pivots on an opposed application by a minority shareholder, Dreyer, seeking to wind up Afristat Investment Holdings. This legal manoeuvre was based on allegations of fraudulent activities, illegality among the directors, and the potential misapplication or squandering of the company’s assets.

The court’s scrutiny of the case was channeled through the lens of Section 81 of the Companies Act, which lays down the criteria under which a court can order the winding up of a solvent company. It’s a section that balances the rights of shareholders against the autonomy of a company, especially when it is financially stable.

Here’s a distilled essence of the case, along with some frequently asked questions to help you understand the implications of this significant judgment.

FAQ 1: What does “solvent” mean in company law?

In the context of company law, a solvent company is one that can pay its debts as they fall due and whose assets exceed its liabilities. The solvency of a company is a key consideration when applying Section 81 of the Companies Act for winding up.

FAQ 2: What grounds did the applicant claim for winding up Afristat Investment Holdings?

The applicant, a minority shareholder, alleged that the directors engaged in fraudulent and illegal conduct and that the company’s assets were being misapplied or wasted. These are serious accusations that, if proven, could justify the dissolution of a company even if it’s solvent.

FAQ 3: On what basis did the court dismiss the application?

The court dismissed the application on several grounds, primarily focusing on the lack of clear pleading of the specific grounds relied upon for winding up under Section 81. Additionally, the applicant did not meet the onus of proving the alleged misapplication or wastage of assets, which is crucial for such claims to succeed.

FAQ 4: What does “just and equitable” mean in the context of this case?

The “just and equitable” requirement is a legal standard that compels the court to consider fairness, the interests of shareholders, and the purpose of the company. In this case, the court noted that this requirement must be seen in context and cannot be used as a broad, standalone criterion for winding up.

FAQ 5: Why was the application for winding up considered impermissible?

The court found it impermissible for the applicant to attempt to change the basis of seeking a winding up at the hearing stage. This goes against the principle that a respondent must know the case it has to meet and prepare accordingly. Shifting grounds at a hearing stage is viewed as procedurally unfair and thus impermissible.

In Summary:

The ruling in Dreyer vs Afristat Investment Holdings echoes the principle that while minority shareholders have rights that need to be protected, the decision to wind up a solvent company must be approached with precision, clear grounds, and substantial evidence. It’s not merely enough to claim wrongdoing; the burden of proof lies heavily on the applicant.

This case serves as a reminder that solvent companies constitute an important pillar of economic stability and the law safeguards them from arbitrary dissolution. It’s a nod towards maintaining the delicate balance between the rights of individuals and the collective interests of corporate entities.