Ever been asked to sign surety for debt? Should it be your child’s study loan, a bond, a car, on behalf of your company or any other debt. This is a big responsibility. You agree to take over payment and be liable for debt should the ‘principal’ not be able to pay it or defaults.

Surety is simply when a person who takes responsibility for another’s performance of an undertaking, for example their appearing in court or paying a debt.

“Signing surety basically means that you are using your good credit rating for someone else’s benefit – and undertaking to extend your credit on their behalf too, if necessary. If they default on their debt, the lender will be looking to you for all the missing funds, so you are in effect signing a deal that says you are a co-borrower.” says Shaun Rademeyer, CEO of Better Life Home Loans, SA’s largest bond originator.

Important points to look out for before signing :

- Set limits

- Make sure the document clearly states that the amount of money is limited to the loan amount.

- The document must contain a clause that states that it is only valid for the duration of the loan period.

- Keep records

- Always keep copies of all the surety documents you sign.

- 2 Keep track of loan repayments and correspondence.

- Written confirmation

- Once the loan has been repaid, make sure you receive written confirmation that the surety has been cancelled. You may need to really push to receive it, but it is worth the effort. Attach this document to the personal surety contract and keep it safe.

- Keep your assets safe

- One of the ways to keep your assets safe is to form a Trust and then transfer the assets to the Trust. However, this can be costly for early stage businesses. Keep it in mind for the future if you cannot afford it now. https://www.finfindeasy.co.za/site/understanding-personal-surety

Here we can look at a few frequently asked questions when dealing with surety:

Q:When will it be necessary to sign surety for someone?

A: One of the most common incidents in which someone signs surety is when a student needs a study loan and needs a guardian or parent to sign surety on your behalf in order to get a loan to get an education. In most cases the student starts paying once they get employment however, with South Africa’s unemployment rate standing at 27.7% (as at 2017) this deems a much bigger task than expected. You need work experience to get a job but need a job to get work experience.

Q: Is there any way of avoiding signing surety?

A: If the creditor insists on either settlement or surety, you could avoid the surety if you can apply for a loan and settle the matter once off and pay the bank directly. However, if you need someone to sign surety for you in the first place it could be assumed that you don’t have a sterling credit record, and this is why you need surety in the first place, in which case you won’t be able to get a loan in any event. Surety would be unavoidable in this instance.

Q: What should I consider before signing surety?

A: Obtain a full credit record from your ‘partner’.

- Establish how your own credit record will be impacted

- Establish how much your ‘partner’ can put down as a deposit

- Have a proper written contract drawn up

- Put a time limit on the surety

Q: When can I cancel/withdraw my surety?

A: A surety can only be cancelled with the permission of the creditor.

If they are willing to cancel a surety, it will only do so if the debt is paid in full or if one surety can be replaced with another or if the remaining surety is financially in a good enough position to satisfy the bank’s requirements. It is very unlikely for a credit to cancel surety or allow the; transfer’ of it but it is not impossible.

IN Conclusion, if you are unsure or are hesitate in signing surety then you should take a step back and ask yourself a simple question, ‘Do I really know what I am committing myself too and is it worth the risk?’

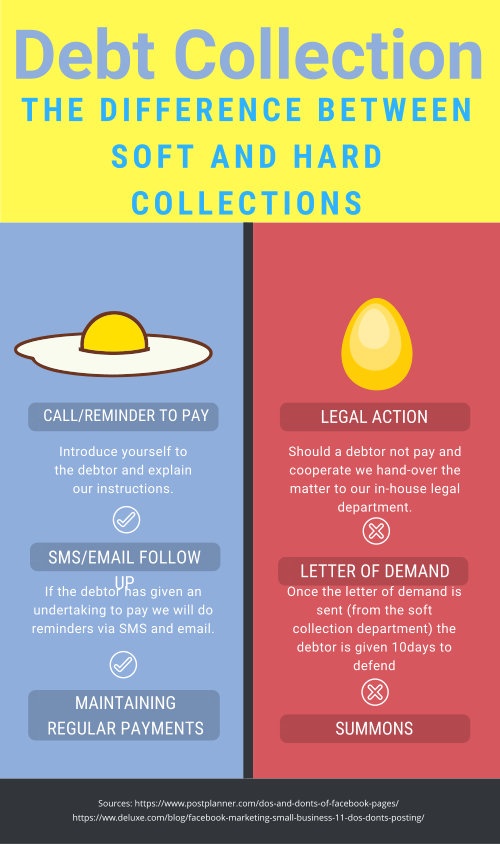

THE DIFFERENCE BETWEEN SOFT AND HARD COLLECTIONS